b&o tax rate

Washingtons BO is an excise tax measured by the value of products gross proceeds of sales or gross income of a business with over 30 different classifications and associated tax rates. Most businesses fall into the 110 of 1 rate including Retail Service such as restaurants and clothing stores.

What Types Of Taxes Must I File As A Washington Based Therapist

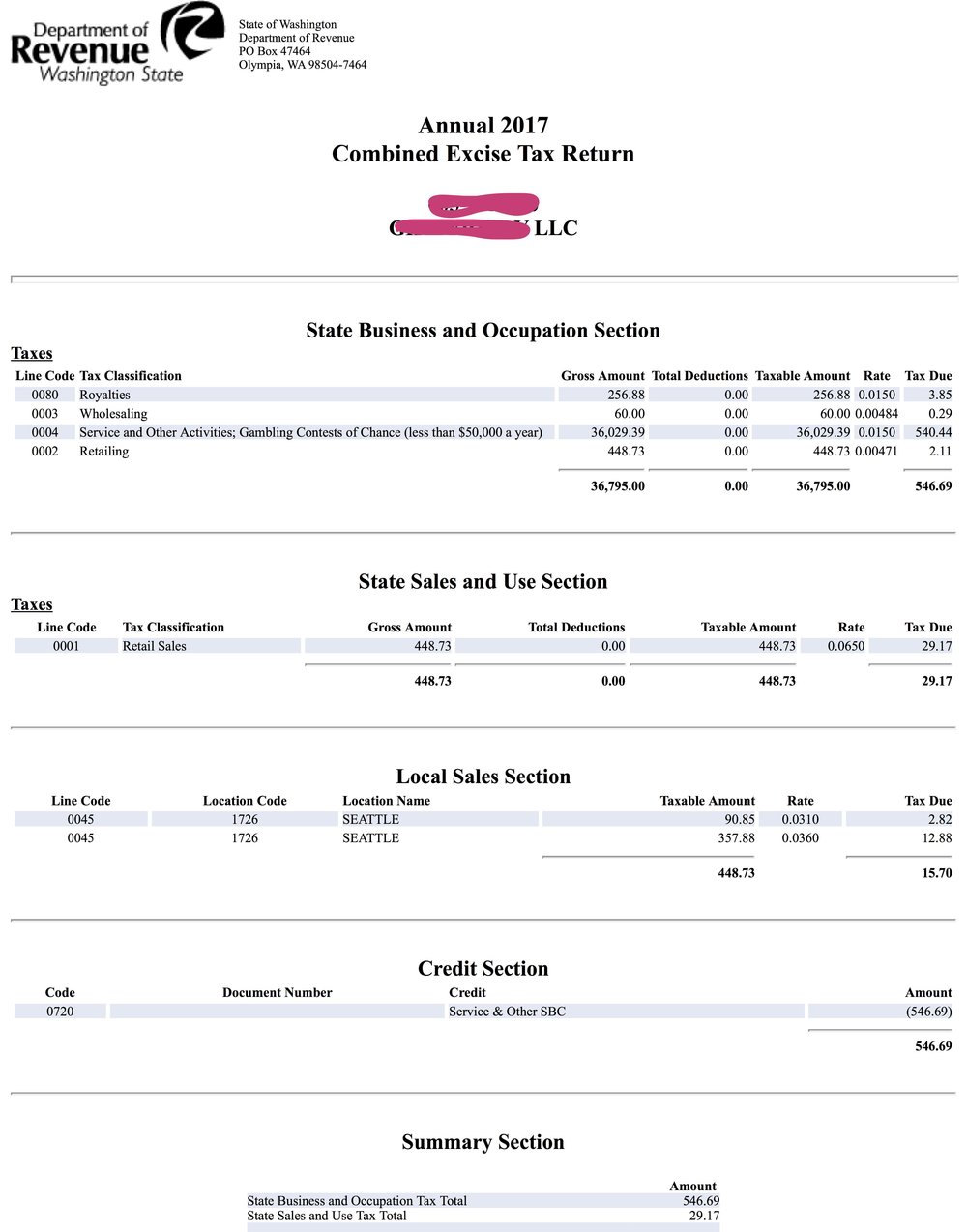

Gross Receipts Tax Classifications.

. B O tax rates When paying the B O tax to the Department of Revenue you declare your income in different categories. What is the sales tax rate in Los Angeles California. V voter approved increase above statutory limit e rate higher.

For example if the retail sales tax rate is. Have a local BO tax. Current Tax Rate for 2022 Revenue and Before Retailing 00050.

This means there are no deductions from the BO tax for labor materials taxes or other costs of doing business. Additionally taxpayers earning over 1M are subject to an additional surtax of 1 making the effective maximum tax rate 133 on income over 1 million. Property taxes in Louisiana typically cost 919 per year but some counties may only charge.

For products manufactured and sold in Washington a business owner is subject to both the Manufacturing. The statewide tax rate is 725. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller.

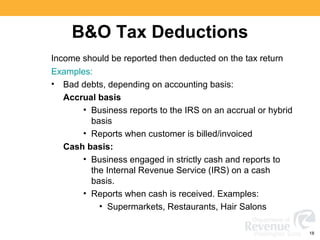

Service providers such as CPA firms architects. The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. Washingtons BO tax is calculated on the gross income from activities.

The current gross receipts tax rate of 01496 percent applies to all gross receipts tax classifications. Business Occupation Taxes The City of Bellevue collects certain taxes from businesses primarily the business and occupation B O tax which includes gross receipts and square. Most Washington businesses fall under the 15 gross receipts tax.

BO Tax Rate Change Beginning Jan. This is the total of state county and city sales tax rates. To calculate this amount multiply your taxable gross revenue amount by the tax rate.

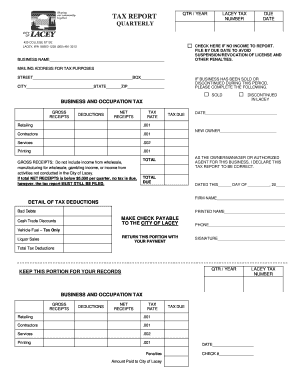

Contact the city directly for specific information or other business licenses or taxes that may apply. Please visit our State of Emergency Tax Relief page for additional information. The BO Tax imposed shall not exceed more that the.

Businesses impacted by recent California fires may qualify for extensions tax relief and more. Louisianas effective property tax rate of 043 is the fifth lowest in the country. Those district tax rates range from 010 to.

Your gross revenue determines the amount of tax you pay. If you have questions you can. How much is the BO tax.

The minimum combined 2022 sales tax rate for Los Angeles California is 95.

Business Occupation Tax Clarksburg Wv

City S Proposed B O Tax Hike Will Hurt Business Economy Kent Reporter

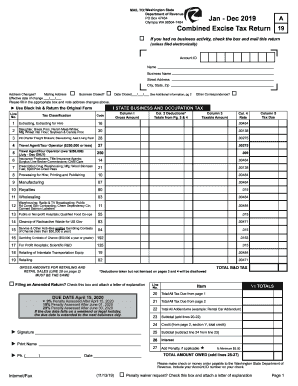

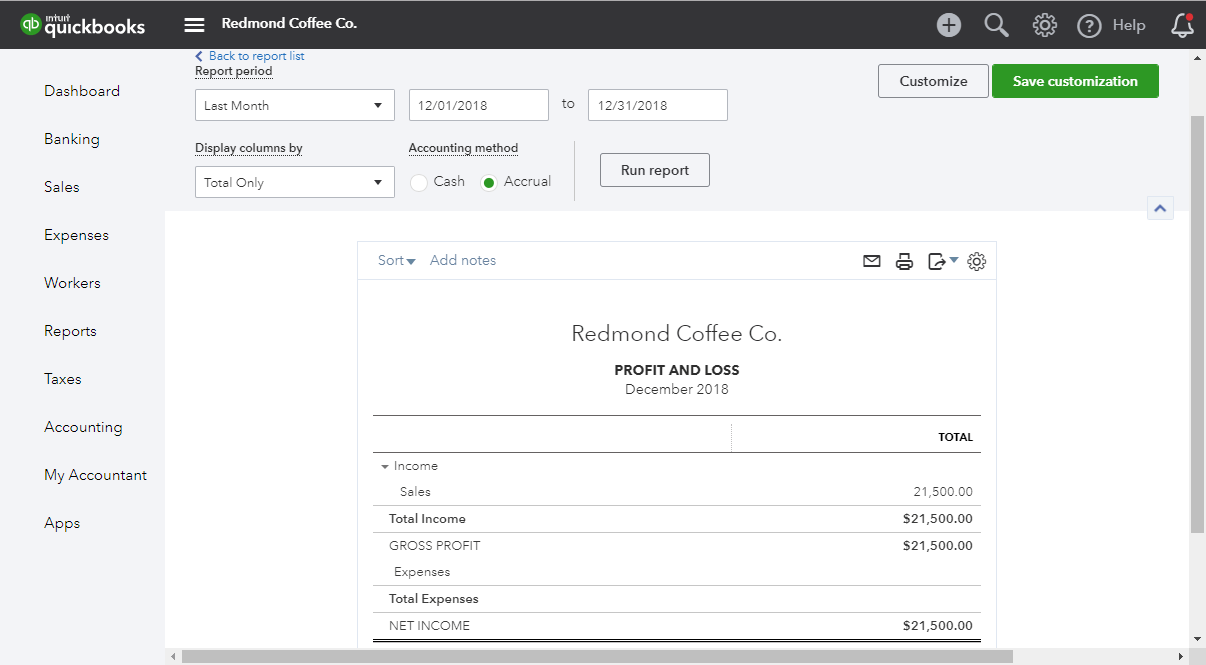

How To Record Washington State Sales Tax In Quickbooks Online Evergreen Small Business

Analyzing The New Oregon Corporate Activity Tax

Why Our B O Tax Is Unfair R Seattlewa

B O Tax Blog Seattle Business Apothecary Resource Center For Self Employed Women

Gross Receipts B O Tax City Of Bellevue

City Of Lacey B O Tax Form Fill Out And Sign Printable Pdf Template Signnow

Business Occupation Tax Bainbridge Island Wa Official Website

Record Wa Dor Excise And Sales Tax Payment In Quickbooks Online Gentle Frog Bookkeeping And Custom Training

Business And Occupation B O Tax Washington State And City Of Bellingham

Washington State Sales Use And B O Tax Workshop

The Infamous B O Tax Seattle Business Magazine

B Amp O Tax Guide City Of Bellevue

Am I Taxed Too Much Understanding The Impacts Of Fiscal Policy Washington State Wire